2022 Year End Market Report

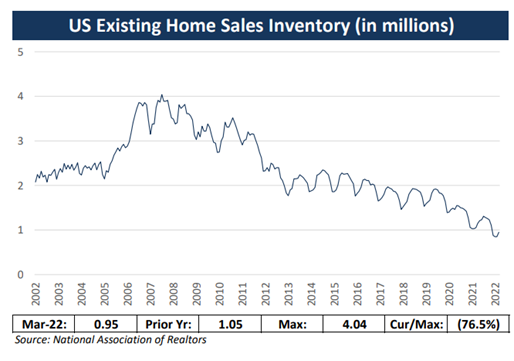

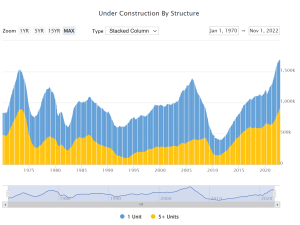

I had to do a double take on this one. We’ve all heard the lack of inventory this year but the above chart highlights just how low the inventory has been. One of the biggest reasons for the inventory shortage is the under production of new single-family homes for the past 13 years. The chart below shows this, housing starts 60% lower than peak levels in 2004. Couple this with people living longer and a new trend that has homeowners living in their home now 18 years on average leads to a supply shortage. The good news is builder supply continues to increase, rates are beginning to peak and all the reasons homeowners need to move are still there. They may have pushed back their timing due to Covid, wanting to enjoy the home remodeling they did over the past few years, but will be ready or needing to make a move.

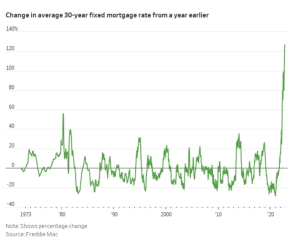

The rate of change in mortgage rates, as we are all painfully aware, is another big reason for supply shortage. While interest rates in the past may have been higher the rate of change to interest rates has not been seen…ever. So now you too can brag to everyone 30 years from now that you were living in a time that interest rates increased over 120% in a year!

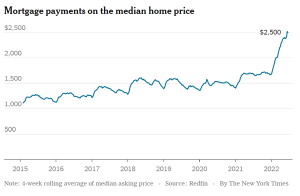

The combination of higher interest rates plus higher home prices caused the average mortgage payment to spike this year. It is hard for sellers who locked in a below 3% interest rate to leave that behind to get an interest rate that is over 6%. That is reflected in the average mortgage payment that is needed to get a home now which has spiked over the last year. Currently, the mortgage payment for a median home price is over $2,500 compared to about $1,700 from the previous year.

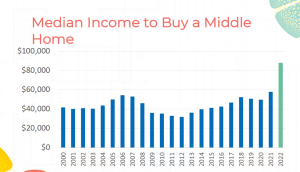

Here is what the average salary is to buy the median home price today. Keep in mind that the median average salary is $55,640. To put this in perspective, the median average salary buying power at a mortgage rate of 3% with 5% down payment could qualify for a purchase price of $350,000. With interest rates at 6%, that purchase price goes down to $250,000. As we all know, $100,000 difference in purchasing power is a massive difference. To afford such a home the salary that one would need to make is over $80,000.

Now look, predictions are always hard. Just look at mortgage rates for instance. The consensus was that rates would maybe top out at 4% and look at where we are. Here are a few things that will help going into next year.

First, more homes are being built. For the better part of a decade new home construction has not kept pace with the demand in demographics. Homebuilders built fewer homes in the decade starting in 2010 than in any 10-year period since the 1960’s. Since 2020 there has been a clear ramp up in construction which we envision will help to alleviate some of the low inventory that is out there. Especially multi-unit properties as single family homes are sometimes out of the reach of many new buyers who are just starting out. Source: npr.org

Inflation has peaked

The worst of the inflation crises has abated, it’s now only a matter of time before inflation is under control. That will only help consumers and boost consumer confidence. The more confident the consumer the more likely they are to spend money which includes buying homes.

Mortgage rates have peaked

If inflation has peaked then so too have mortgage rates. The Fed has already started to indicate that the pace of rate hikes will slow down or potentially even stop early next year. If that is the case then mortgage rates will surely follow.

The housing market will continue to soften

Already we have seen that more negotiations are taking place on offers. Home inspections and sometimes even seller assist is being added. That was a sticking point to many borrowers as they didn’t want to buy a home above asking price plus also having to waive inspections.

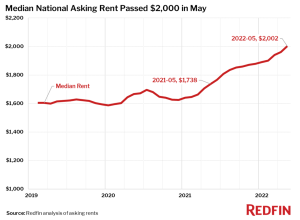

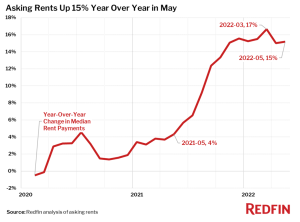

The cost to rent is going up as well

Let’s not forget that there is an opportunity cost to not buying a home. Rent prices have, for the most part, kept up with the rising prices of homes. Which makes sense. If it costs more for an investor to buy a property they are going to charge more for rent. The data supports this as the median rent surpassed $2,000 a month for the first time ever this year. Rent increases have increased year over year by 12-13%. Buying a home fixes that. The monthly payment is stable for the life of the loan. The best part is that it’s a one-way transaction. If rates go lower, it’s easy to refinance and get an even lower rate. This makes for great protection against inflation. For instance, in a worse case scenario where inflation keeps rising, what do you think rents will do? If rents keep rising 10-15% each year, it doesn’t matter if you own your home, your monthly payment stays the same. Source: vox.com

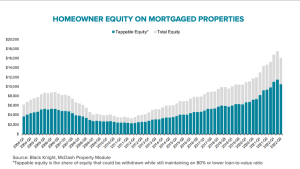

Real estate will remain a key part for retirement:

Not only does a home protect against inflation it’s also a key source of building wealth for the average American. Look no further than this year when the S&P 500 is currently down over 20% YTD. Meanwhile the amount of equity in homes is at an all time high. Having that ability to tap into this equity during a year when the stock market has taken a hit like this is a lifeline to many Americans.

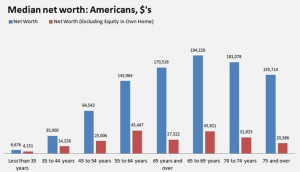

Just look at the difference in net worth when subtracting the value of their home. I know we hear it all the time that homes are just too expensive, or the monthly payment is too much but this chart just brings it home that without a home the average American is going to be much worse off. To most Americans, a house is not only where they call home it can also mean the difference in a comfortable retirement vs. a stressful one.

I’d like to leave this report on a reminder of what is at stake here. We have the privilege of being in an industry where our product is literally life changing. Make no mistake; that is what having a home is. What else would you call it? If you went to someone and said, “I have a product that will make you almost eight times richer by the time you are 75,” wouldn’t that be life changing?

There is no doubt that there are challenges in the market right now. In many ways it’s never been more expensive to own a home than ever before. It’s important that we remind our clients to take a longer view when making their decision. There is an expression about the stock market that goes ‘time in the market beats timing the market’. Meaning that it’s more important to be in the market so you can take advantage of your asset appreciating in value than trying to pick and choose the best time to enter the market. Often sitting on the sidelines means missing out. That is true of the real estate market as well. I would bet that people that were looking to buy in 2020 but didn’t are kicking themselves right now that they didn’t pull the trigger. The same could be said about last year as well. How many people missed out on a home because they didn’t want to pay an extra $5,000-$10,000? Or because they didn’t want to compete with other offers?

In the meantime home values in our area have gone up 20%-30%. To make use of another expression (which I’ll modify slightly) the best time to buy a home was 20 years ago, the next best time to buy a home is right now.

Recap: