7/11-Rate cuts look all but guaranteed in September

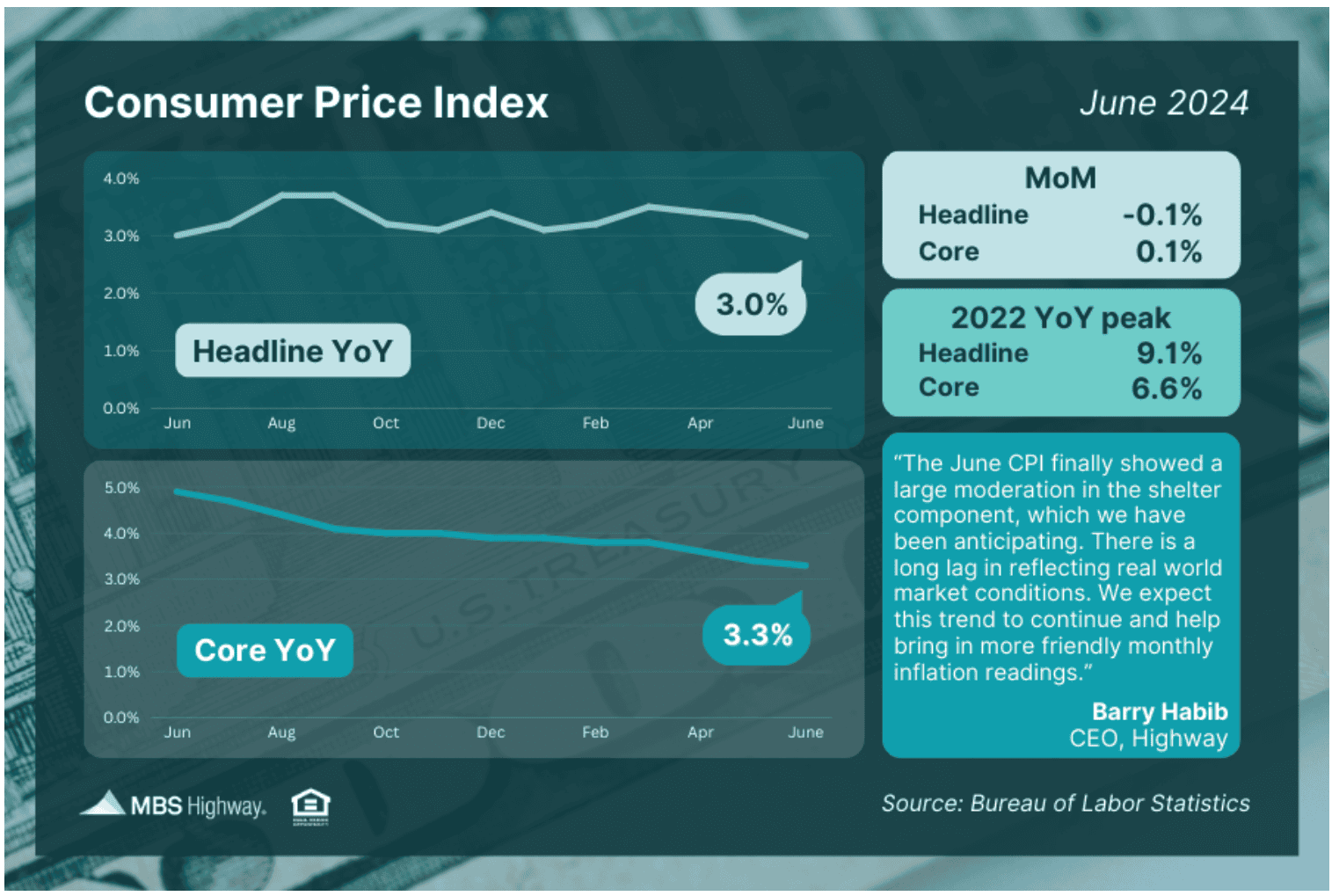

The much anticipated inflation report for June came out today and I’ll only briefly bore you with details before getting to the good parts I promise. The Headline Consumer Price Index (that’s gobbledygook meaning inflation report) fell 0.1% from May to June, marking the first monthly decline since the start of the pandemic. You might look at that .1% decline in inflation and go, ok big whoop? I know that doesn’t sound impressive but remember this is month over month numbers, plus we don’t have as far to get to in order to hit the Fed inflation target of 2%. Currently inflation is right at 3%. As long as the Fed sees that inflation is on a trajectory of their 2% target that will give them enough cover to cut rates.

Verify your mortgage eligibility (Jul 12th, 2025)Speaking of which, this report almost certainly means that the Fed will start cutting rates in September. Their next meeting is at the end of July and I don’t think there is enough in this report to get them to cut at that meeting. Plus the Fed is very careful to telegraph their next move and in their previous meeting in June they didn’t indicate that a cut was in the cards for July. If there is a rate cut in September Chairman Powell will all but state it in his comments to the press during his meeting.

So what does this mean for you? Well this is your chance to get ahead of your clients before they call you in September. You can bet that when a cut is announced it’s going to be plastered over every news outlet and that is what everyone will be talking about. Here’s the thing though, by the time rates do get cut it will likely be priced into the market already. For instance, rates are dropping today in anticipation of rates being cut in September. By the time the rate cut is announced mortgage rates probably won’t have much of a reaction at all. Now is the time to get those pre-approvals updated, or have your clients start the pre-approval process, so that they can beat the rush when more people are going to enter the market on news that the Fed is cutting rates.

Recap:

Verify your mortgage eligibility (Jul 12th, 2025)-June inflation report showed lower inflation

-Next Fed meeting at the end of July, Chairman Powell will likely state that first rate cut is for September

-Mortgage rates are starting to price in rate cuts already

Show me today's rates (Jul 12th, 2025)