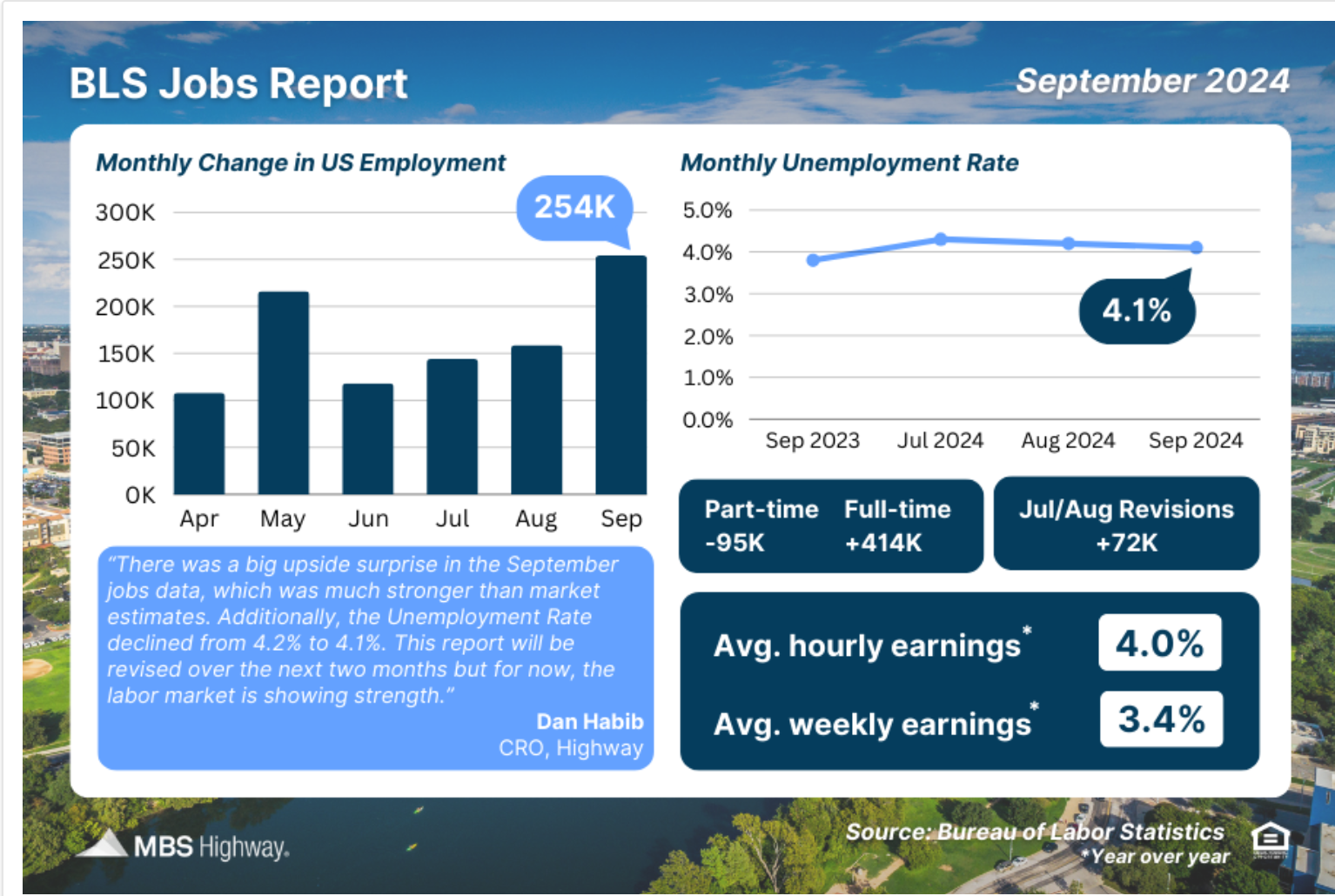

BLS Jobs Report

You didn’t think it was always going to be that easy right? After months of rates declining in a pretty orderly fashion rates have hit a bit of a wall. Rates jumped up today as the job report for September was well above estimates, as the September jobs report saw 254K new jobs were created versus the 140K that were forecasted. Revisions to previous data for July and August also added 72K jobs from those months combined, while the unemployment rate fell slightly to 4.1%

Verify your mortgage eligibility (Feb 24th, 2026)While this report is great news for the economy it is less so for mortgage rates. A strong economy doesn’t need as many rate cuts which is why mortgage rates are moving lower. While there will still likely be rate cuts in November and December they may be smaller than what was previous thought. While previous reports showed a lot of part time jobs being created this report shows more full time employment. It’s important to remember that this is just one report and by itself won’t mean to much. However if we continue to get strong job numbers then the Fed could be more patient when it comes to cutting rates.

Recap:

- Stronger than expected job reports causes rates to rise

- Still likely the Fed cuts rates again in November and December

- More strong numbers like this could cause the Fed to slow rate cuts